As we prepare to close out 2022, it’s a good time to take a closer look at your finances and think about if there are any ways to improve your tax position. This year, inflation in Canada rose significantly due to the high cost of energy and food.…

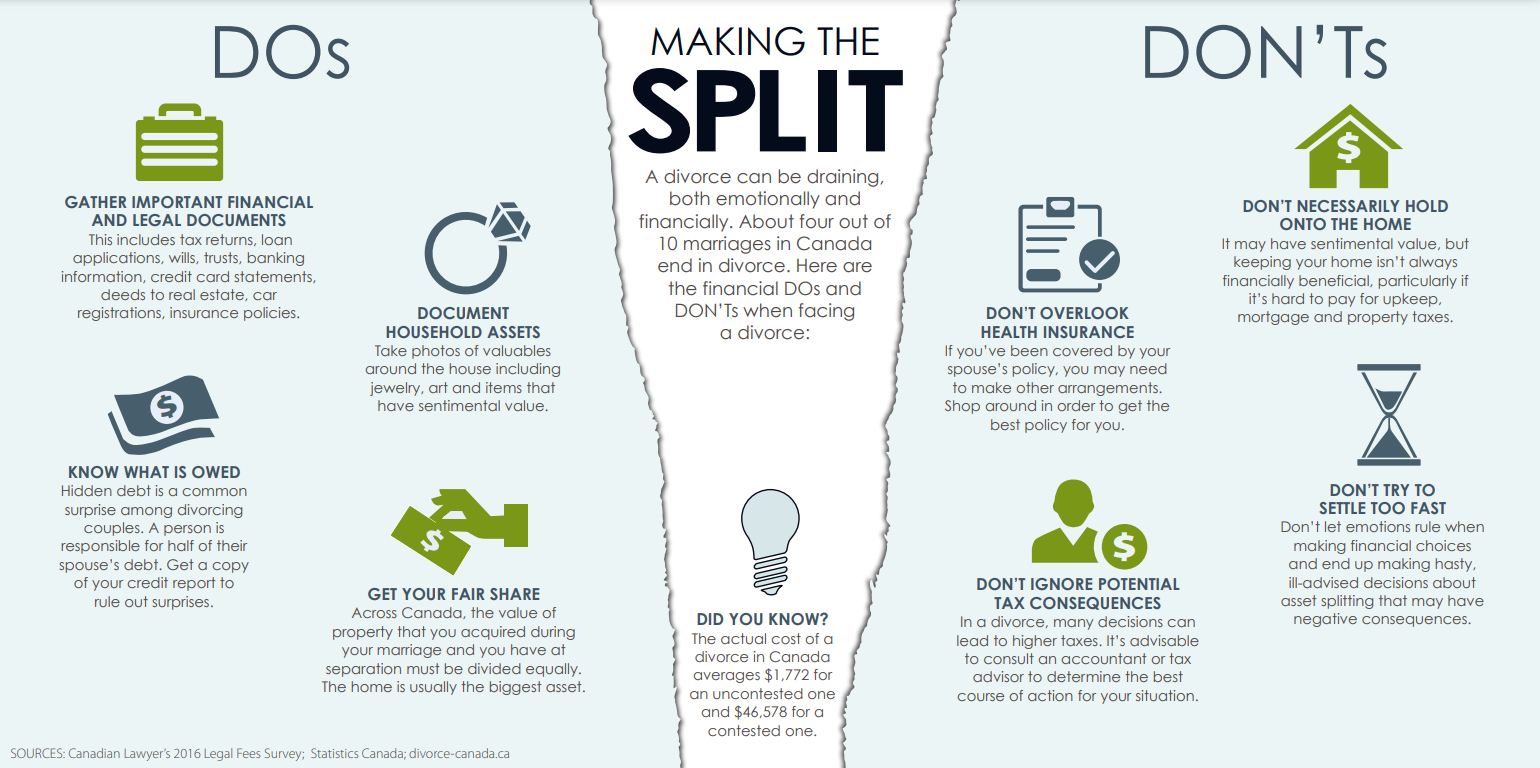

A divorce can be draining, both emotionally and financially. About four out of 10 marriages in Canada end in divorce. Here are the financial DOs and DON’Ts when facing a divorce: Do's Gather Important Financial And Legal Documents This includes tax returns, loan applications, wills, trusts, banking information,…

In August 2022, the government released draft legislation to implement the new Tax-Free First Home Savings Account (FHSA). The FHSA is expected to launch at some point in 2023, so to get you prepared, here’s a guide to what we know so far. The basics This brand new…

If you are the sole owner of a corporation that has appreciated in value over time and is expected to continue growing, there are ways to structure the ownership of your corporation to improve tax efficiency and simplify the planning for your estate. An estate freeze is a…