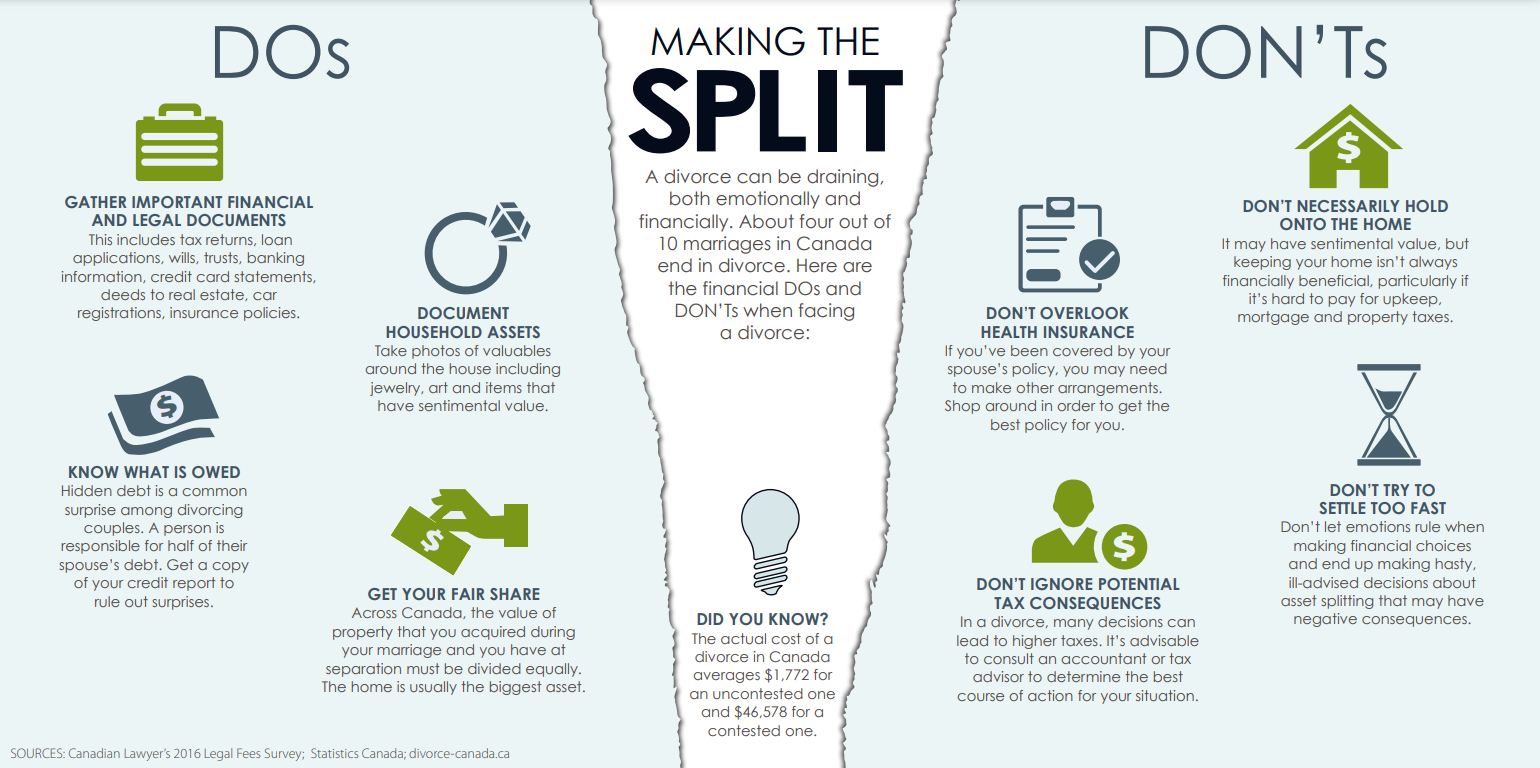

A divorce can be draining, both emotionally and financially. About four out of 10 marriages in Canada end in divorce. Here are the financial DOs and DON’Ts when facing a divorce:

Do’s

Gather Important Financial And Legal Documents

This includes tax returns, loan applications, wills, trusts, banking information, credit card statements, deeds to real estate, car registrations, insurance policies.

Document Household Assets

Take photos of valuables around the house including jewelry, art and items that have sentimental value.

Know What Is Owed

Hidden debt is a common surprise among divorcing couples. A person is responsible for half of their spouse’s debt. Get a copy of your credit report to rule out surprises.

Get Your Fair Share

Across Canada, the value of property that you acquired during your marriage and you have at separation must be divided equally. The home is usually the biggest asset.

Don’ts

Don’t Overlook Health Insurance

If you’ve been covered by your spouse’s policy, you may need to make other arrangements. Shop around in order to get the best policy for you.

Don’t Necessarily Hold Onto The Home

It may have sentimental value, but keeping your home isn’t always financially beneficial, particularly if it’s hard to pay for upkeep, DOCUMENT mortgage and property taxes.

Don’t Ignore Potential Tax Consequences

In a divorce, many decisions can lead to higher taxes. It’s advisable to consult an accountant or tax advisor to determine the best course of action for your situation.

Don’t Try To Settle Too Fast

Don’t let emotions rule when making financial choices and end up making hasty, ill-advised decisions about asset splitting that may have negative consequences.