Managing market volatility in retirement

In retirement, there are three potential threats to your financial well-being:

- Longevity risk—the risk that you outlive your savings

- Inflation risk—the risk that cost of living is higher than you planned for

- Market risk—the risk that market volatility decreases the value of your portfolio

- Sequence of returns risk—a subset of market risk where the market falls just before or early in your retirement, making it difficult to recover your savings

A solid investment strategy can help you plan for longevity and infl ation risk—but market risk is perhaps the most unpredictable and harmful to your financial well-being. This is especially true at or around your retirement date.

That’s where a Cash Wedge Strategy can help.

What is it?

A Cash Wedge Strategy can help to steady your retirement income in times of volatility. The goal is to allocate a portion of your portfolio to cash to help meet your current income needs, while still diversifying the rest of your portfolio so you can benefit from participating in the market.

Who should consider it?

Retirees who rely on their portfolio for a regular source of income, and are concerned with potential market volatility might consider employing a Cash Wedge Strategy.

What are the benefits?

Employing a Cash Wedge Strategy can help you:

- Reduce the impact of sequence of returns risk on your portfolio

- Increase portfolio liquidity to better manage large purchases or unexpected expenses

- Ensure short term income is not subject to market declines

What is “sequence of returns”?

Sequence of returns is the order in which gains or losses happen in a portfolio—which is particularly important as you begin to draw income from your portfolio (withdrawal phase).

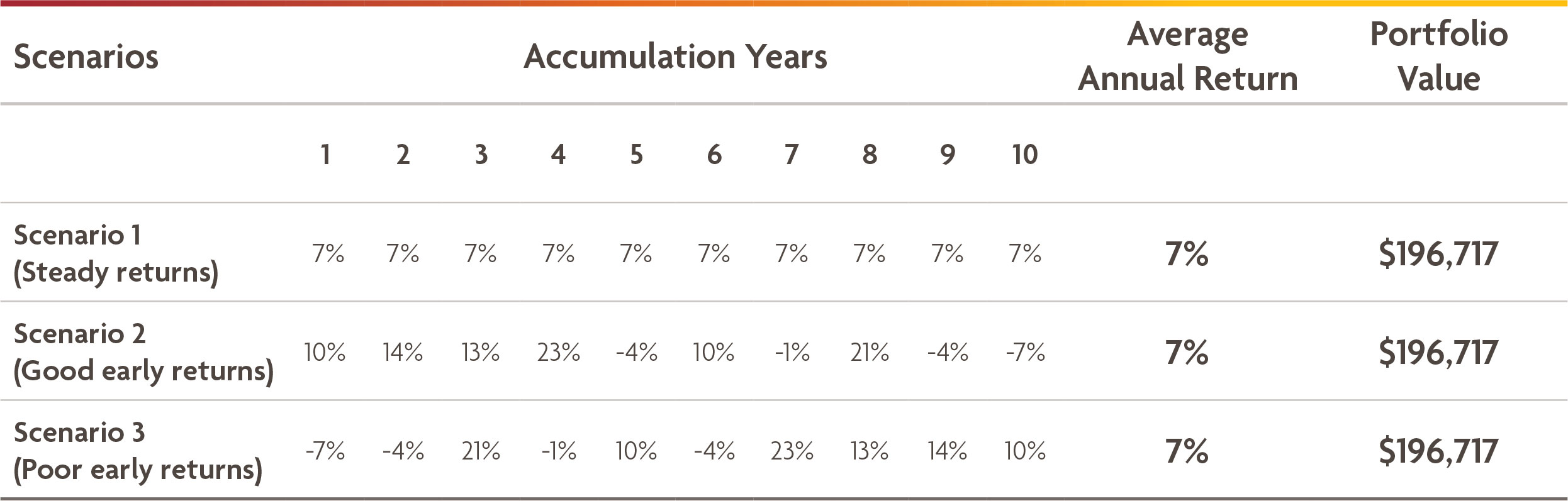

Exhibit 1 shows what happens to an investment of $100,000 over a 10-year period in the accumulation phase when an investor is saving for retirement. The three hypothetical scenarios all have average annual returns of 7%, with returns happening in a different order, but since no money is withdrawn they result in same ending dollar value of $196,717 in all three cases.

Exhibit 1: Sequence of returns in accumulation phase

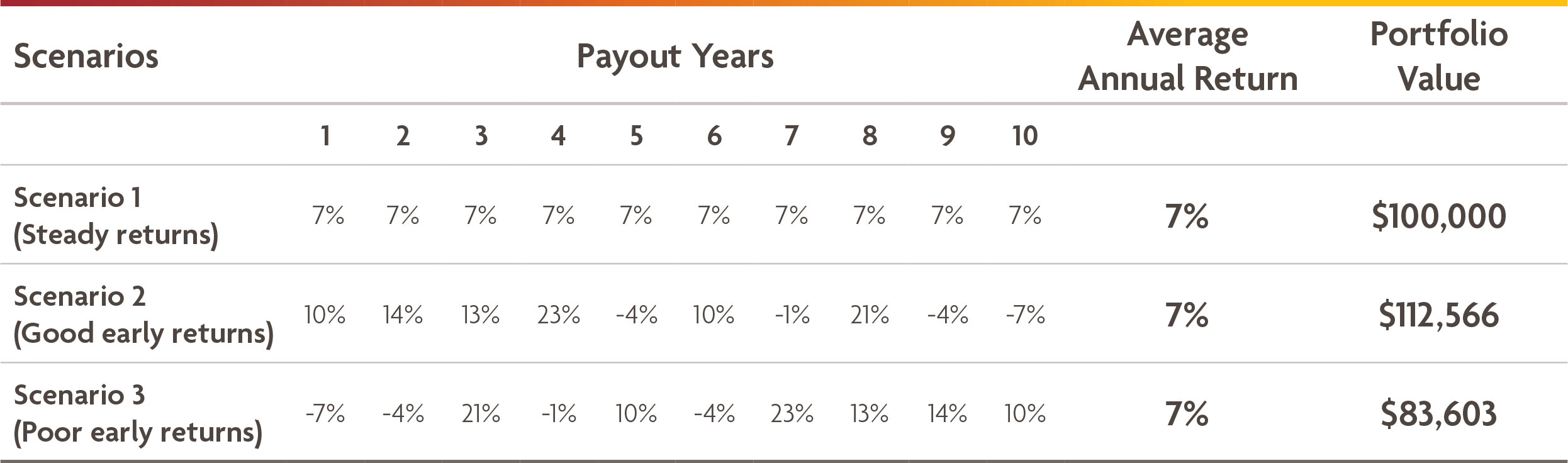

Exhibit 2 shows what happens to $100,000 investment over a 10-year period when an investor is withdrawing $7,000 per year.

While the average return over 10 years is 7% for all three hypothetical scenarios, the order of returns does make a difference. Negative returns early in the 10-year period (Scenario 3) result in significantly less capital at the end of the investment period.

Exhibit 2: Sequence of returns in withdrawal phase

These illustrations do not reflect any taxation, fees, or expenses. Source: Your Retirement Income Blueprint, D. Diamond, Milner & Associates Inc., 2011

Clearly, the sequence of returns is very important in the early years of retirement. Negative markets early on are far worse than negative markets later. In fact, they can mean that your savings may not last the full length of your retirement.

How does the Cash Wedge Strategy work?

This approach can help protect your portfolio in times of market volatility, while still allowing you to participate in the markets.

Your advisor can help allocate your retirement portfolio into three components:

- Cash wedge. A portion of your projected retirement income (often one year’s worth) is allocated to liquid, conservative investments (e.g., Money Market Fund). You will draw your retirement income from this.

- Shorter term, conservative investments. Approximately two years’ worth of projected retirement income is allocated into a low volatility short-term investment [e.g., guaranteed investment certificates, guaranteed interest contracts or a bond fund], providing stability with some potential for growth. In years two and three, you will draw on these to replenish the Cash Wedge.

- Personalized diversification. The rest of your portfolio is allocated to match your individual investment profile. Over time any profits are moved from this part of the portfolio into the cash wedge or shorter-term portion to create income throughout your retirement.