What To Expect And Income Needs

Many believe that expenses decrease during retirement. While this is generally true, depending on the retiree, there are some expenses that might increase during this period. The following charts discuss common expenses and whether they tend to increase or decrease in retirement.

Expenses that normally decrease in retirement

| Work-related Cost | ▪ Long commutes and related transportation costs end. Expensive lunches and costly work attire also tend to go away |

|---|---|

| Income tax | ▪ If your income will decrease in retirement, so will your income tax bill. Seniors might also be eligible for certain tax breaks, such as pension income-splitting and the pension tax credit. |

| Housing | ▪ Housing costs might decrease if mortgages are paid off and/or downsizing occurs. On the other hand, these costs might also increase if specialized seniors housing is required. |

| Contributions to retirement savings | ▪ Mid-career households are often more concerned with saving for retirement than retiree households. Also, Canada/Quebec Pension Plan contributions cease when employment or self-employment ends. |

| Cost of items/services | ▪ Retirees tend to have more time to seek out the best deals. They also have access to “seniors’ pricing” for many items and services. |

Expenses that normally increase in retirement

| Health care | ▪ Medical costs tend to rise as we age, and many Canadians lose employer-paid health-care coverage upon retirement. Specialized long-term care might also be required. |

|---|---|

| Utilities | ▪ Spending more time at home normally means increased utility costs (e.g., heating, cooling) |

| Travel and entertainment | ▪ With more available time, many retirees look to travel and pursue other forms of entertainment for leisure (e.g., clubs and memberships). These can increase expenses in retirement. |

| Maintenance and other household expenses | ▪ Many household chores (e.g., lawncare, snow shovelling, cleaning) can be difficult for retirees to carry out. Many will look to contracted help for these chores, which can add to expenses in retirement. |

| Gifts and donations | ▪ Gifts to children and grandchildren tend to increase in retirement. Charitable donations might also increase as retirees fulfill philanthropic aspirations. |

Working with a financial advisor can help to identify trends, which can help to predict and manage expenses in retirement.

Estimating Income Needs In Retirement – Replacement Ratio Vs Budget-based Calculations

A key component of retirement planning is the calculation of required income. Two methods commonly used to estimate income needs are the replacement ratio and budget-based methods. The replacement ratio method is a quick “rule-of-thumb” estimate commonly used in the years leading up to retirement (experts often suggest 70–90% of pre-retirement income). The budget-based method is a more detailed calculation often done shortly (i.e., 6–12 months) before retirement when accuracy is important.

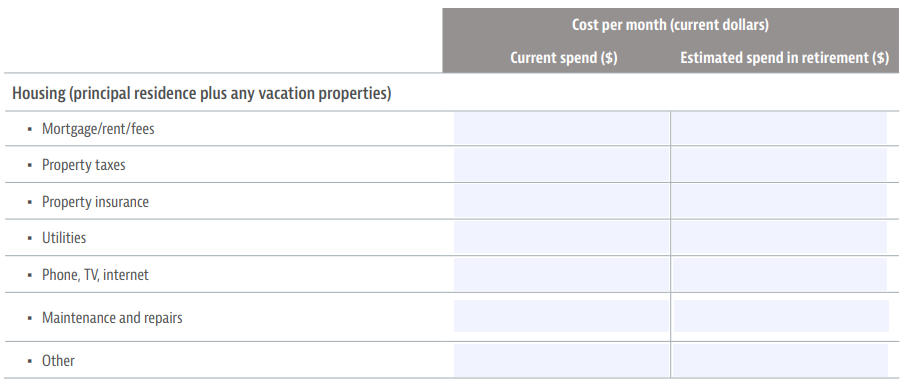

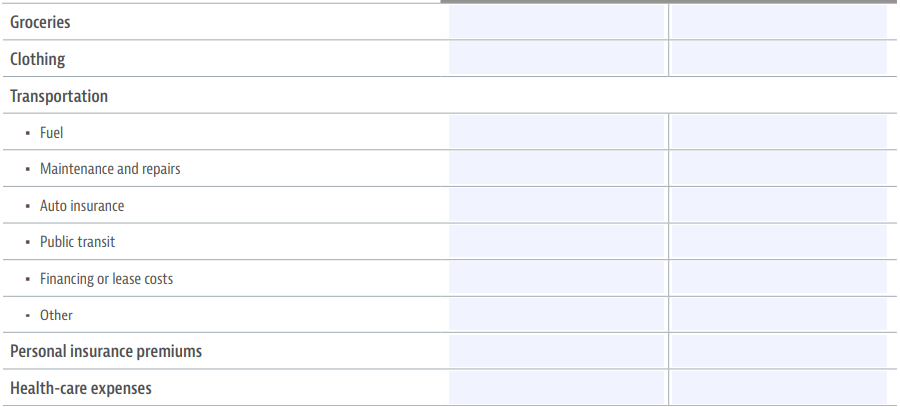

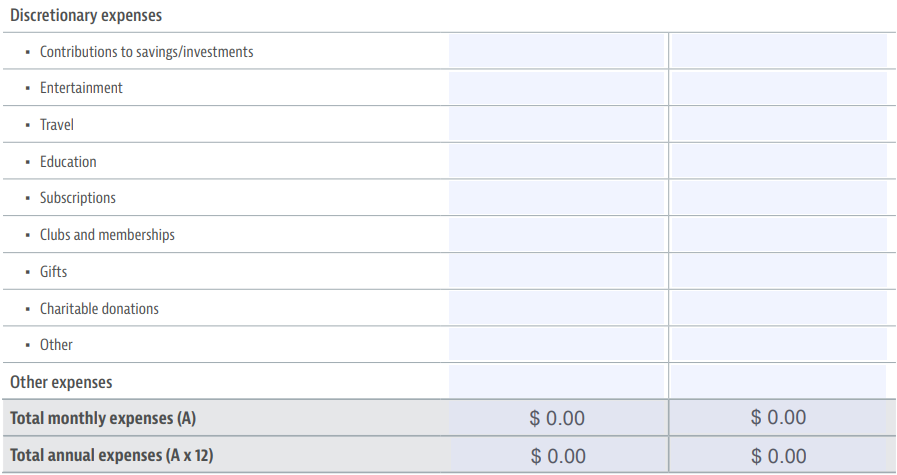

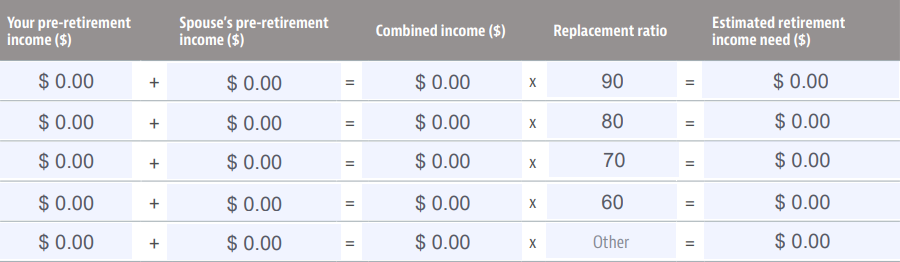

The tables below are designed to assist in estimating retirement income needs using the replacement ratio and/or budget-based methods.*

Replacement Ratio Method

To estimate your retirement income needs, list your pre-retirement income and that of your spouse or common-law partner, if any. Then, decide on a replacement ratio (several amounts are provided below for comparison purposes) and multiply. This will provide an estimate of your retirement income needs, stated in current before-tax dollars, based on your selected replacement ratio.

Budget-based Method

A detailed budget-based calculation can more precisely estimate needs in retirement. It is often the preferred method when closer to retirement and accuracy is important.